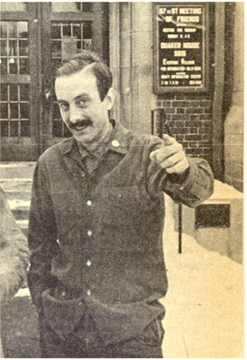

Karl Meyer stands in front of a Quaker

Meeting House.

karl meyer is in jail

“…his ultimate decision was to plead ‘nolo contendere’ and forego a jury trial. Only Karl could completely explain the reasons for this decision, but since he can’t at this writing, following are some of the factors, learned through several conversations, that played a part.”

The last issue of Tax Talk carried an article by Karl Meyer regarding his indictment on five counts of filing false W-4 forms from 1968 to 1970. On May 21 Karl was sentenced on two of the counts and received the maximum penalty of two years and $1,000. He is serving his sentence at Sandstone Federal Prison and will be released December 27, 1972, or sooner if granted parole.

When he wrote the last article, Karl was thinking of defending himself, asking for an immediate jury trial. He didn’t wish to waste movement resources for legal defense and felt he could explain his case better than anyone else.

However, between that writing and his court date May 7, his thinking changed and his ultimate decision was to plead “nolo contendere” and forego a jury trial. Only Karl could completely explain the reasons for this decision, but since he can’t at this writing, following are some of the factors, learned through several conversations, that played a part.

Family considerations—the possibility of a long separation from his wife and three children—partially influenced his decision. He did not feel the court could or would empanel a jury of his peers and he thought the court procedures involving testimony before a jury would be too cumbersome.

From his previous personal experience in the courtroom, he believed he could best explain his motives on a one-to-one basis, i.e., by talking directly to and confronting the judge as a person rather than through a lawyer to a group of 12. He realized that everything would depend on the sympathies or empathy of the judge and was prepared for the worst, but did hope by this method to win a lighter than maximum sentence.

Finally, he knew he was legally innocent and could prove it on three of five counts. He was ready to plead innocent on all charges if necessary (separate pleas not being allowed) but the prosecutor agreed to drop the three charges as requested. Karl then pleaded nolo on the other two, and Judge Perry entered it as guilty according to court procedure. Perry asked for a four week presentencing investigation; Karl requested only two weeks and the date was set for May 21.

At the sentencing, the US attorney made his statement first: 1) regardless of his moral reasons, the fact was that Karl had flagrantly broken the law; 2) Collection of taxes is the cornerstone of the operation of the federal government and to permit one person for whatever reason not to pay, would invite anarchy. He cited Karl’s ten years of resistance to taxes and how he had changed jobs to avoid collection. He then spent several minutes reading from Catholic Worker articles, as evidence that Karl is a leader who hoped others would follow his example and methods of resisting. He concluded by asking that Karl be given the maximum sentence.

Karl responded, acknowledging his ten years of resistance and the authorship of the Catholic Worker articles. He stated he had always tried to refuse taxes as openly as possible. The judge interrupted to say that openness does not make something right—a man who robs a bank does so openly. Karl then elaborated on his reasons for non-payment of the federal tax—that 70% of it is used for military purposes. He explained that he does pay city and state taxes, even though he does not always approved of the way they are spent, because they are not collected primarily to support killing.

After Karl concluded, Judge Perry was very curt, saying he did not wish to waste any more of the court’s time with this matter. In his opinion, the defendant obviously was not repentant and had no regrets, so he concurred with the prosecuting attorney. He read the maximum sentence of 1 year and $1,000 on each count, to run consecutively. He added that he would consider concurrent sentences should Karl show any later signs of repentance.

About 25 people appeared for the sentencing, including Karl’s 7 year old son William and Bill Himmelbauer, another resister who pleaded “nolo contendere” on the count of W-4 falsification and will be sentenced June 22. There was no organized demonstration, but people stood to express their support and farewells as Karl left and the judge immediately ordered the courtroom cleared.

There is a limit on the number of people Karl can write to, but apparently no limit on the number who can write to him. His address is: Karl Meyer #8561-147, Post Office 1000, Sandstone, Minnesota 55072

—Mary Ann Marfia

Click here for Printer-Friendly Version

Click here to Return to Historical Gems Page